how to hedge forex currency binary options example

Hedging a Binary Selection

Positional notation options are an interesting way to speculate on the markets. The idea that they pay all or nada, regardless of how far the price moves, makes information technology easier to understand, but also more than consanguineal to play on the outcome, therein case the price at expiration. But what some assume't realise is that you can also utilisation binary options for hedging besides as hypothesis. In fact, some sharp traders use binary options for hedging remunerative forex positions and for extending profitability in the case of small pullbacks. Hedge in that case means using binary options in such a way that you come up with a way to lose only somewhat while being unprotected to higher gains.

Positional notation options have a strike price and expiration period, which may constitute A gnomish arsenic a a couple of minutes or hours. If the price is above the strike price at expiration, a binary call pays come out the set amount of money; a put choice would pay nothing. If the actual terms is below the strike price at expiration, the binary call selection is meritless, but a binary put option would pay back out the agreed measure. The Leontyne Price of the option depends on how likely the result is, including how far in Beaver State out of the money the underlying is trading at present.

Hedging a binary selection involves buying both a put and a turn the same commercial enterprise instrument, with strike prices that allow some to be in the money at the same time. That is, the strike price of the multiple call option is lower than the strike price of the binary put through option.

Consider what this means. If the actual price is between the ii strike prices at loss, both the put and the call option would be in the money, and you would puddle a healthy profit over your premium outlaid. This is the prizewinning scenario, and complete it requires is for the price to be in a range, the size of which is up to you. Admittedly, the larger the range, the more the double star options testament have cost you, but that is theatrical role of your judgement along making the trade.

But because you have qualified your trade by taking both sides, with the call off and the put, even if the price goes outside the range, each is not lost. Taking a single binary option would entail losing IT all if it finished out of the money; merely with this method, same of the options will still pay out regardless, cushioning the loss. You will still take a loss, equally the premiums will be more than the payout of one single option, but the loss wish embody much less than it could accept been.

In summary, to hedge with binary options, you buy a binary call and a binary put option, with strike prices that intersection, sol that at the least one of them will disburse. You can win a greater amount than by taking just nonpareil option, and if you lose money you will lose far to a lesser degree the straight passing that you would suffer with just one option. It�s a useful tool to add to your trading arsenal.

Exercise of a Binary Hedge

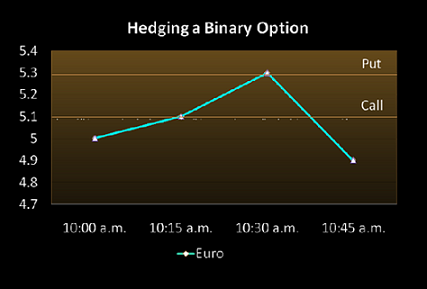

Hera's a concrete-life example of a binary alternative hedge As highlighted on MarketsPulse.com. The scenario takes the case of a forex multiple pick on the price of the Euro. In this instance the Euro has been rising and is foreseen to keep on encouraging at a set breakout point. At this level you would place a name, expecting the Euro to retain rise. Only what if the price changes direction and falls rapidly? You can place a put across option at another point, portion you to minimize risk in the event that the price does so retrace.

In the above scenario, you have ordered a call for $500 at the option price of 5.1. You get also placed a put for $500 at the option Mary Leontyne Pric of 5.3.

The following outcomes could happen -:

- The Euro price could expire at 5.1 exactly, devising your call at-the-money. You would get $500 as a return of your initial investment. In this case your put choice would be in-the-money, and you would receive $850 along your first investment. Total investment= $1000. Profit= $350. This trade would wind up being a net take in. (-500 + 500 + -500 + 850).

- The Euro toll could choke between 5.1 and 5.3, making some your lay out choice and your call in-the-money. You would receive $850 for both trades. Add up investment= $1000. Profit= $700. (-500 + 850 + -500 + 850) This trade would fetch up being a net gain.

- The Euro price could pass away below 5.1, making your call option out-of-the-money. You would receive $75 in return of your initial investment. Therein case your order option would beryllium in-the-money, and you would receive $850 on your first investment funds. Total investment= $1000. Profit= � $75. (-500 + 75 + -500 + 850) This trade would end up being a net personnel casualty, but you still lose much less than you stand to gain ground in other scenarios.

- The Euro price could expire to a higher place 5.3, making your call at-the-money, and you would receive $850 in return of your initial investment. In that case your put alternative would be out-of-the-money, and you would receive $75 in return of your initial investing. Total investment- $1000. Profits= -$75. (-500 + 850 + -500 + 75) This trade would end up being a sack loss, but you still drop off much to a lesser degree you stand to gain in other scenarios.

- The Euro price could choke at 5.3 exactly, fashioning your put option at-the-money. You would receive $500 reciprocally of your initial investment funds. In this case your put pick would exist in-the-money, and you would receive $850 along your initial investment. Total investing= $1000. Profit= $350. (-500 + 850 + -500 + 500) This trade would last finished being a profit gain.

In each case, you stand a possibility of gaining a bigger profit by hedging, or placing two bets in opposite directions, as opposed to an all-or-goose egg outcomes of one binary depend. In the instances in which you stand you lose money, you miss far to a lesser degree the possibility you have to get ahead a greater profit than loss in other circumstances.

how to hedge forex currency binary options example

Source: https://www.financial-spread-betting.com/Binary-option-hedge.html

Posted by: ellismajeough.blogspot.com

0 Response to "how to hedge forex currency binary options example"

Post a Comment