Forex Market Times In My Time Zone

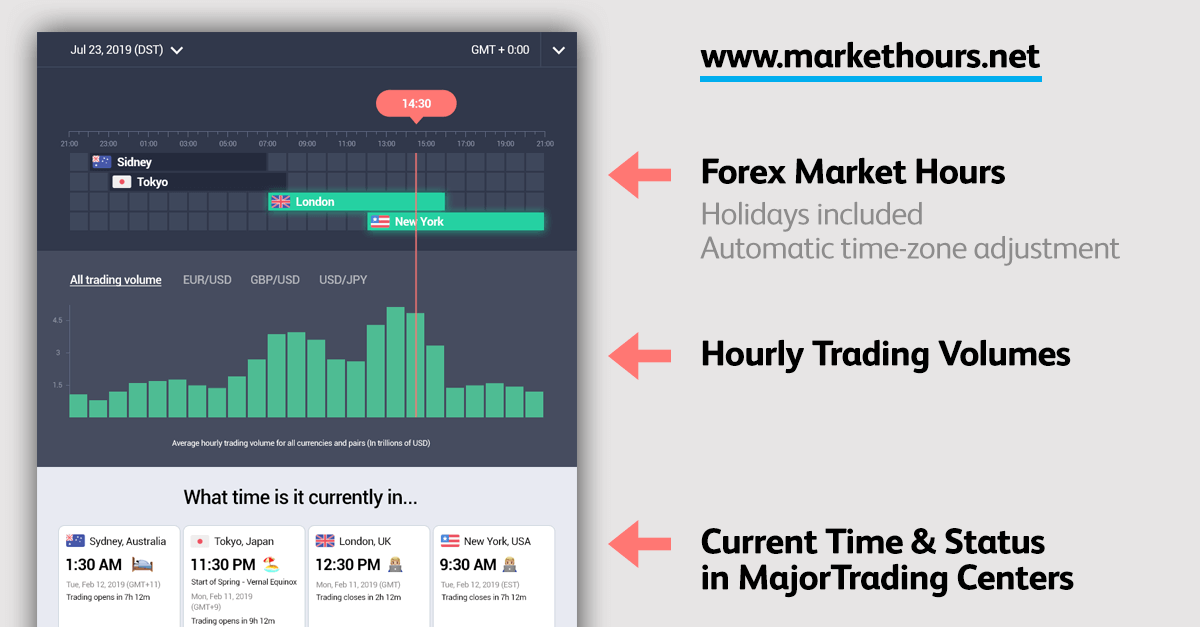

Forex Market Hours

Uncover what is the best and worst time to trade forex. See forex market trading hours at a glance. Cheque when the forex market place opens and closes in London, New York, Sydney, Tokyo. Your time zone is adjusted automatically! Unlike with other tools - national bank holidays and weekends are taken into account.

How to Use This Forex Market Hours Tool

- View the opening and endmost times of the major markets in your local time zone. If y'all want to switch the time zone, use the search/dropdown menu in the tiptop right corner.

- To cheque for future forex market hours and holidays, click on the date at the summit left of the tool.

- View the historical average of hourly trading volumes on the unabridged forex market. This will give you an idea of the times with the most liquidity and the smallest spreads.

- Toggle between the three major currency pairs to encounter the average hourly volatility in pips to further decide the most advisable time depending on your trading fashion.

Liquidity shows how active a market is. A currency pair has a loftier level of liquidity when it is easily bought or sold and at that place is a significant amount of trading activity for that pair.

During periods of reduced liquidity, currency rates are subject to more sudden and volatile price movements.

The spread is a commission that brokers charge you lot for making a trade. It is the gap between the bid and the ask prices.

Volatility describes the level of moves of an exchange rate.

When only 1 market place is open, currency pairs can get locked in a tight band of ~ thirty pips of movement.

Two open markets at once can hands push the movement to more than seventy pips, especially when big news are released.

A pip is the smallest measure of change in a currency pair.

As near major currency pairs are priced to four decimal places, a pip is usually $0.0001 for currency pairs with the Us dollar.

Why We Made This Tool

It was a rainy day in October when we got fed up with all the faulty forex market hour charts.

To utilize one, we had to calculate the conversion from a unlike time zone.

Some other one had a dropdown with hundreds of time zones. Still, it had no search function, so nosotros had to scroll endlessly.

The third one did not take the daylight savings transitions into account… Moreover, most of them did not show up-to-date holidays when the markets are closed or have fiddling activity.

"Screw this mess!" we thought and set out to build our own tool which solves the shortcomings of the others.

It'south notwithstanding in beta, and so please allow us know if you find any issues or take ideas for comeback.

The Big Market Timing Mistake Anybody Keeps Telling Us About

Have you lot ever Googled, "When is the all-time time for trading?"

If you lot do, you volition notice that well-nigh of the resource are maxim the same thing:

"The best fourth dimension to trade is during the London/New York overlap and other times of high market volatility."

Information technology sounds so nice and simple. Just guess what?

A research report of 24 one thousand thousand real trades showed a surprising fact - this approach is wrong for a large number of traders!

It turns out that most traders are range traders (read forth to see if you're one of them) who could increment their likelihood of success from 47% to 55% if they traded during lower volatility times instead of high volatility periods.

Ouch, And so When Is the Best Time for Trading Forex?

Contrary to what others may tell yous, in that location is NO universal best time for trading!

The all-time times depend on what type of trading y'all are planning to do.

Times of tiptop market volatility might be good for some strategies and not so adept for others.

At that place are three major types of forex trading strategies:

- Range trading

- Breakout trading

- News trading

And here are the appropriate best trading times for each of these trading types:

- If you are a range trader and then yous should trade when the markets are less volatile. Likewise, y'all should avert trading when economical data is coming out. The all-time time for range traders to trade is during the Asian (Tokyo) session.

- Breakout traders are the ones who tin do good from volatile markets, and so the best fourth dimension for breakout trading is during the famous London/New York overlap, and also during the opening hours of the London session.

- News traders should apparently time their trades around news releases. The more volatile the news the improve. Unremarkably, the biggest moves are created when the Us information comes out. Why? Considering the Us dollar plays a role in just under 90% of all forex transactions (88% for the U.s.a. dollar against 31% for the Euro and 22% for the japanese Yen in 2016 according to BIS report). The nearly volatile news report for the US is the NFP (Non-Farms Payroll). The NFP is usually released on the kickoff Fri of every month at 8:30 AM New York fourth dimension.

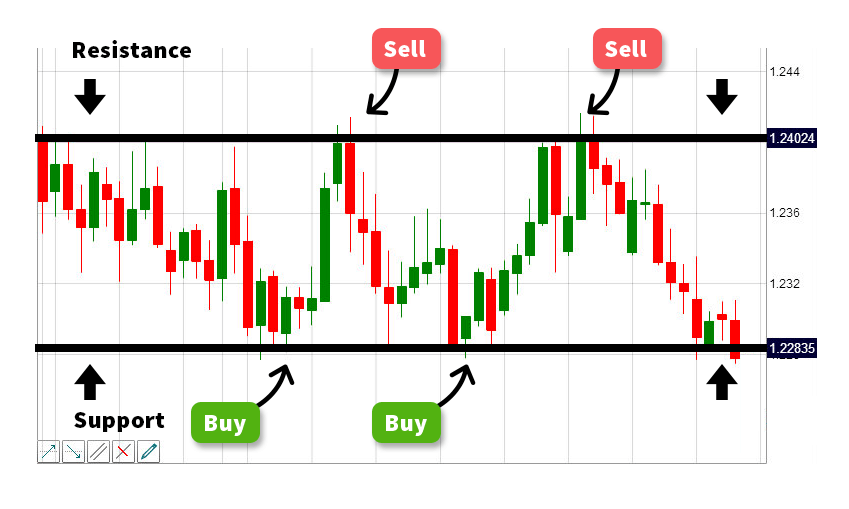

Range Trading works all-time if a price is moving within relatively narrow ranges and is not breaking through the support or resistance levels.

This is usually the case during the quiet Sydney and Tokyo session hours.

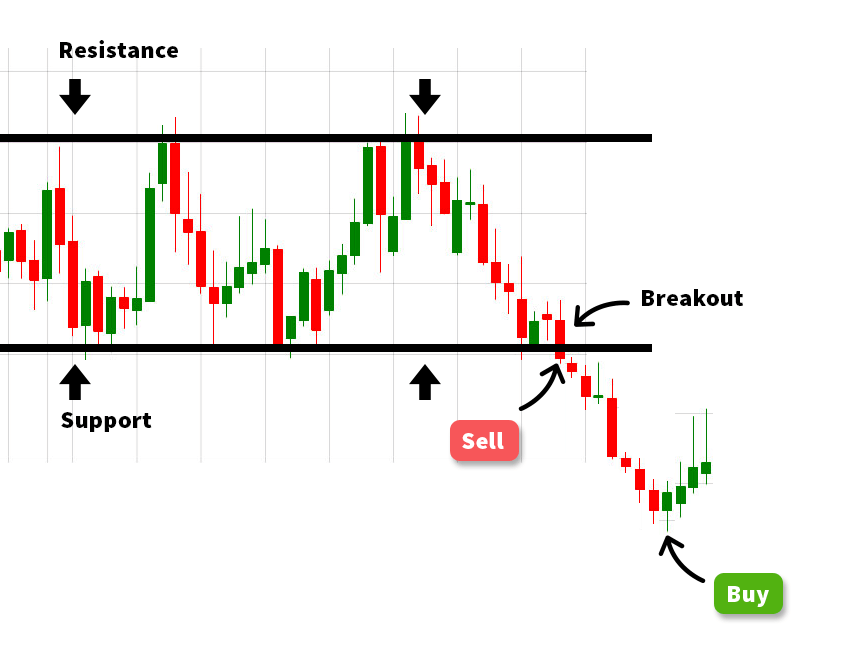

The goal of a breakout trade is to enter the market correct when the cost makes a breakout from a previous range and so continue to ride the trade until the trend diminishes.

A sign for a potential breakout can be found using technical assay or by anticipating or reacting to news.

The Worst 3 Times to Merchandise Forex

Sure times can exist specially challenging to make coin in the forex market place.

These times include the days earlier, during and after a major international vacation, such as Christmas or New Twelvemonth's.

Major bank holidays in the United States, the U.k. or Europe can as well adversely affect trading volumes, often leading to sharp moves in thin markets that tin can trigger Terminate-Loss orders.

For most traders, the following are among the worst times to execute forex trades:

- The Witching Hour. The loneliest and scariest time in the forex market is when the sun is just rising in Tokyo and traders in Sydney are drinking their first cup of coffee. The time between the New York close and the start of trading in Tokyo has always been a fourth dimension when investors avoid trading if possible. During these two hours, forex trading volumes can subtract to simply 2% of peak turnover. Thus, liquidity is super low. Consequently, the spreads become very loftier and whatever transaction completed during that flow tin influence the marketplace disproportionately. It is during this time that many terminate-losses get triggered and flash crashes happen more frequently.

- Sunday Afternoon Opening. The market place opening on Sunday often carries an element of surprise, especially if a major geopolitical issue happened over the weekend. Forex currency pairs tend to gap upward or downward during the offset of the Sydney session. Also, dealing spreads are typically then wide that y'all would usually exist wise to await at to the lowest degree until the Tokyo opening to get a better idea of what the market is similar.

- Wednesday Rollover. In the middle of the calendar week, there is a tricky rollover commission that surprises many novice traders. What is a rollover? If you hold a position open on a weekday night, unremarkably your broker charges or adds an involvement rate to your account. This interest is called a "Rollover".

And now comes the big one - on weekends, the forex markets are closed for trading, simply rollover interest is yet existence counted. As per manufacture standards, brokers use an interest equal to 3 days of rollover on Wednesdays.

Nevertheless, there are some brokers who unify the rollover fees then traders pay the same amounts for every night from Monday to Friday.

For those who don't go on trades open during the night, (intraday traders) rollover is not a business organization. If a position is opened after 5:00 PM (New York time) on the previous solar day and closed before 5:00 PM (New York time) on the current day, and so no rollover is credited or debited.

Before trading, it is wise to cheque the rollover terms of your chosen broker.

A stop-loss guild protects y'all from losing more than than you lot are willing to risk. Before opening a trade you tin can specify a price level at which your position volition be automatically closed.

At that place can be 2 types of stop-loss orders:

- Normal Stop-Loss: information technology automatically closes your position at the all-time available toll, meaning that sometimes yous tin can lose more than predicted due to slippages.

- Guaranteed Stop-Loss: it closes your position at exactly the toll level y'all specified, and then at that place is no risk of gapping or slippage. Thus your loss will never exceed your predicted level. But yous manifestly have to pay extra spread for such an advantage.

Can Y'all Trade Forex on Weekends?

Usually, you can't. The forex market is closed for retail traders on weekends.

The currency market closes on Friday v:00 PM New York time (10:00 PM London time), when the New York session finalizes, and reopens on Sunday at 5:00 PM New York time (x:00 PM London time).

Just…here's the take hold of #ane: The FX market is not airtight for everyone! Cardinal banks and related institutions can proceed pushing around billions, even on weekends.

As well, when a huge transaction takes identify during the weekend, it can create a affair called the weekend gap, which can cause your stop-losses to go triggered and your position to close.

If, on Sunday, the opening-price is higher than Fri'south high price price, you lot will have a gap up. If the toll opens lower, y'all will have a gap downwardly.

That's why traders usually either gear up wider stops or close their positions entirely over the weekend.

And here'south the catch #2: Some brokers permit yous to trade fifty-fifty during the weekend, just spreads will be much bigger during weekends when liquidity is super sparse or virtually non-existent.

Source: https://www.markethours.net/

Posted by: ellismajeough.blogspot.com

0 Response to "Forex Market Times In My Time Zone"

Post a Comment