Learn Forex Trading South Africa

Best Trading Platform South Africa 2022 – Cheapest Platform Revealed

Advertiser Disclosure

Advertiser Disclosure

If yous're based in South Africa and looking for the all-time trading platform in 2022 – yous've got dozens of providers to choose from.

Many of these platforms requite you lot access to thousands of fiscal markets at low or even cipher commission. You do, of grade, besides need to consider the safety of your funds – and so e'er pick a platform that is regulated.

In this guide, nosotros reveal the best and cheapest online trading platform Southward Africa. Nosotros also show you how to select a South Africa trading platform for your needs and how to become started with an account today.

Best Online Trading Platforms South Africa 2022 List

Looking to start buying and selling fiscal instruments with the best trading platform in Due south Africa correct at present? Check out our list of the best providers below!

- FXVC – Overall All-time Stock Banker in Due south Africa

- Libertex– Low-Toll Trading App With Zilch Spreads

- AvaTrade – Trusted South Africa Trading Platform with MT4/five

- VantageFX– Best Forex Trading Platform in Southward Africa

- Plus500 – Best Trading Platform for S African Stock CFDs

- Skilling – All-time Trading Platform in South Africa for Cryptocurrencies

- CM Trading – Best Broker in South Africa with FSCA License

- Uppercase.com – Overall Best and Cheapest Online Trading Platform South Africa

Visit Site

Past profits do not guarantee future profits.

Visit Site

71% of retail investor accounts lose money when trading CFDs with this provider.

Visit Site

CFDs are complex instruments and come with a high risk of losing money speedily due to leverage. 75.3% of retail investor accounts lose money when trading CFDs with this provider.

Visit Site

eighty.eighteen%% of retail investor accounts lose money when trading CFDs with this provider.

Mobile App Rating

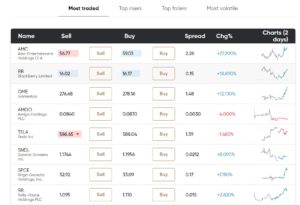

| 9/ten | ix/x | 8/10 | 9/10 |

Min. Trade

| Northward/A | Due north/A | N/A | N/A |

Leverage

| i:20 | one:x | 1:five | one:v |

Margin trading

No. of Shares

| 1000+ | N/A | N/A | N/A |

No. of ETFs

| 250+ | Northward/A | N/A | N/A |

Fixed fees per trade

| $0 | $0 | $0.07 | $0 |

Cost per Month

| $0 | $0 | $0 | $0 |

ETFs

| 0.52% | 0.13% | N/A | North/A |

Funds

| N/A | N/A | North/A | N/A |

CFDs

| Northward/A | 0.007% | N/A | 0.005% |

Savings Plans

| N/A | N/A | N/A | N/A |

Crypto

| 0.33% | 0.20% | 0.2% | 0.07% |

Bonds

| N/A | 0.02% | North/A | N/A |

Trading Fees

| Spreads | Spreads | Commissions or Spreads | Spreads |

Withdrawal Fees

| $0 | $0 | 29$ or 1% | $0 |

Inactivity Fees

| $0 | $50 later iii months, $100 after 12 months | $v/month after 90 days | $0 |

Deposit Fees

| $0 | $0 | 0% to 4% | $0 |

Overnight CFD Position

| N/A | N/A | N/A | Northward/A |

Credit Card

Neteller

Skrill

Paypal

Best Brokers in S Africa Reviewed

As noted higher up, there are dozens of online trading platforms available to South Africa. Some of these providers cover a wide variety of assets – and so this might include stock trading platforms, CFD trading platforms, and even Bitcoin trading platforms.

Either way, there are many considerations to brand when finding the all-time trading platform in South Africa – such as fees, payments, support, and safety.

Taking all of these of import metrics into business relationship, below you will find which providers made the cutting every bit the best trading platform in Due south Africa for 2022!

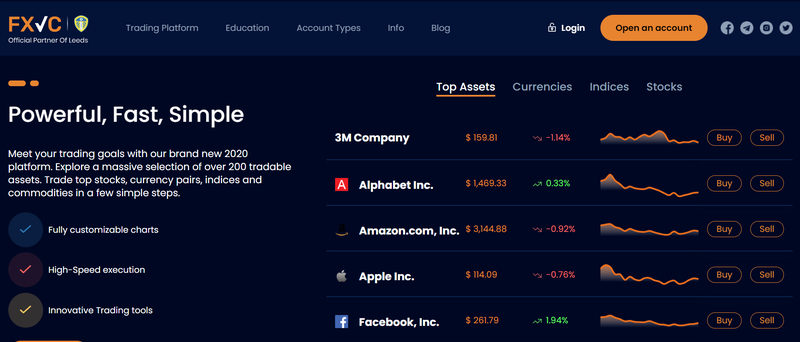

1. FXVC – Overall All-time Stock Broker in Due south Africa

FXVC is a great option if yous're looking for a South African stock broker with depression fees, a wide range of shares, and some great trading tools. Information technology offers loads of different stock CFDs from different exchanges, and so you tin can trade on the toll of major companies like Amazon and Apple tree.

FXVC is a great option if yous're looking for a South African stock broker with depression fees, a wide range of shares, and some great trading tools. Information technology offers loads of different stock CFDs from different exchanges, and so you tin can trade on the toll of major companies like Amazon and Apple tree.

You can do this with very depression fees, as well, thanks to FXVC's competitive spreads. This broker also comes upwards trumps when information technology comes to execution speeds, offer some of the fastest in the industry with extremely low latency.

You lot can trade via the FXVC spider web platform or via the mobile app, which is very well designed and user-friendly. Both provide access to a wide range of technical and cardinal assay tools to assist yous execute your trading strategies. There is also a wide range of research and analysis resources available, including daily market reviews, assay, and fifty-fifty ebooks.

FXVC caters to both novice and experienced traders with five account types, so you can choose the one that best suits yous.

Pros:

- Wide range of shares to merchandise

- Depression spreads

- Extremely fast execution

- Useful inquiry & trading tools

- Cull from five accounts

- Intuitive mobile app

Cons:

- Doesn't accept PayPal

Your upper-case letter is at risk.

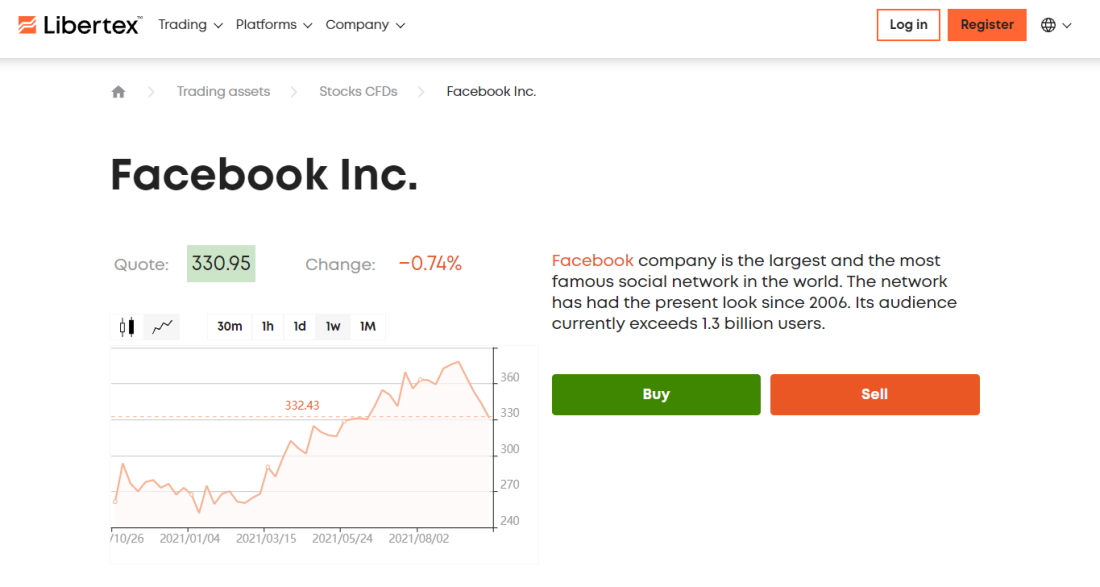

2. Libertex– Low-Cost Trading App With ZERO Spreads

If you're looking to buy and sell CFDs online you might want to consider Libertex. CFD trading allows you to proceeds wider market access and build a diversified portfolio. Libertex offers a wide range of CFD asset classes roofing stocks, cryptos, indices, bolt and more. One of the broker'south all-time selling points is that you tin trade with zero bid-ask spreads.

Established in 1997, Libertex is an online CFD and forex banker with a strong rail record that spans over two decades. The provider is now home to over ii.2 million traders worldwide.

When it comes to the trading platform itself, LIbertex offers two options. The Libertex web trader may be amend suited for beginner traders while advanced investors can trade with MT4. MetaTrader 4 offers a range of technical indicators, drawing tools, customizable charts, and fifty-fifty robo-advisors.

In terms of deposits and withdrawals, you will have access to a full range of supported payment methods including debit/credit cards, e-wallets and bank transfers.

Libertex Pty., is a S African financial services provider and is regulated and supervised by the Financial Sector Conduct Dominance (FSCA) with FSP Number 47381. For the best FSCA brokers be sure to also read our in-depth guide.

Pros:

- Nada spreads and low commissions

- Convenient mobile app

- Access to 250+ tradable CFD avails

- Supports MT4 and MT5

- Regulated by FSCA

Cons:

- Cannot trade real stocks or ETFs

83% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade - Trusted South Africa Trading Platform with MT4/five

If you lot're looking for the all-time trading platform in Southward Africa that is compatible with the MetaTrader series, AvaTrade might be the best option on the table. In fact, not just is the platform compatible with MT4, but also MT5. This allows y'all to trade from the comfort of your dwelling house in a fully-immersive way.

If you lot're looking for the all-time trading platform in Southward Africa that is compatible with the MetaTrader series, AvaTrade might be the best option on the table. In fact, not just is the platform compatible with MT4, but also MT5. This allows y'all to trade from the comfort of your dwelling house in a fully-immersive way.

By this, nosotros mean that MT4/five via AvaTrade supports dozens of technical indicators, trading signals, chart drawing tools, and connectivity with forex EAs. Also as allowing VIX trading, making it our best volatility 75 index broker every bit you can automate a VIX trading arroyo. AvaTrade also offers its own native trading platform that is available online or via an iOS/Android app.

There is even the AvaOptions platform that is dedicated exclusively to options trading. When it comes to supported markets, everything at AvaTrade is packaged as a CFD musical instrument. Once over again, this ways you'll benefit from low fees, leverage, and brusk-selling capabilities. No commissions are charged past this platform, as everything is built into the spread.

If you lot like the sound of this tiptop-rated MT4 broker, AvaTrade accounts take minutes to open up. The minimum deposit is just $100 and you tin can add funds via a S African depository financial institution account, debit card, and a number of e-wallets. Finally, AvaTrade is authorized to operate in multiple jurisdictions - including full regulation by the S African Financial Sector Conduct Authority (FSCA).

Pros:

- Supports MT4/5

- Broad range of tradable instruments

- Educational materials

- Islamic trading business relationship

- ASIC and FSCA regulated

Cons:

- Does not offer traditional stock ownership – CFDs simply

72% of retail CFD accounts lose money with this provider.

iv. VantageFX - Best Forex Trading Platform in South Africa

VantageFX is an international forex broker that allows you to merchandise major forex pairs with leverage up to 500:1. The banker offers CFDs for more than forty currency pairs to trade. While this might non exist the widest option among forex brokers in S Africa, there are a lot of things that help VantageFX stand out.

VantageFX is an international forex broker that allows you to merchandise major forex pairs with leverage up to 500:1. The banker offers CFDs for more than forty currency pairs to trade. While this might non exist the widest option among forex brokers in S Africa, there are a lot of things that help VantageFX stand out.

To start, VantageFX offers commission-free trading accounts with a minimum eolith of just $200. Spreads beginning from 1.4 pips, which is fairly inexpensive. In addition, VantageFX offers ProECN and RawECN trading accounts. These send your orders directly to liquidity pools for execution, and they don't carry any spreads. Instead, you lot pay a commission from $ii per merchandise for the ProECN business relationship or $three per trade for the RawECN business relationship.

VantageFX offers traders the popular MetaTrader four and MetaTrader v trading platforms. That means you can utilize powerful trading tools similar forex signals, create custom technical indicators, and backtest your indicators against historical cost data.

On top of that, VantageFX integrates with Myfxbook, ZuluTrade, and Duplitrade. These social trading platforms give you lot unique insight into the forex market. Plus, all 3 platforms enable you to copy other forex traders, so you tin easily automate your trading. Between the iii platforms, yous'll take thousands of traders to choose from to copy.

VantageFX is regulated past the United kingdom of great britain and northern ireland FCA and ASIC. The banker doesn't charge deposit, withdrawal, or inactivity fees,. You can fund your account using a debit menu, credit card, or banking concern transfer.

Pros:

- Offers ECN trading accounts

- Commission-free trading with spreads from 1.4 pips

- Integrates with MT4 and MT5

- Supports Myfxbook, ZuluTrade, and Duplitrade

- FCA and ASIC regulated

Cons:

- Limited selection of currency pairs to merchandise

Your capital is at take chances.

5. Plus500 – Best Trading Platform for South African Stock CFDs

If y'all're looking for the best trading platform in South Africa to merchandise stock CFDs - look no further than Plus500. Not only does this pinnacle-rated provider allow you to trade stocks listed in the United states, U.k., Commonwealth of australia, Japan, and much of Europe - but Southward Africa, too.

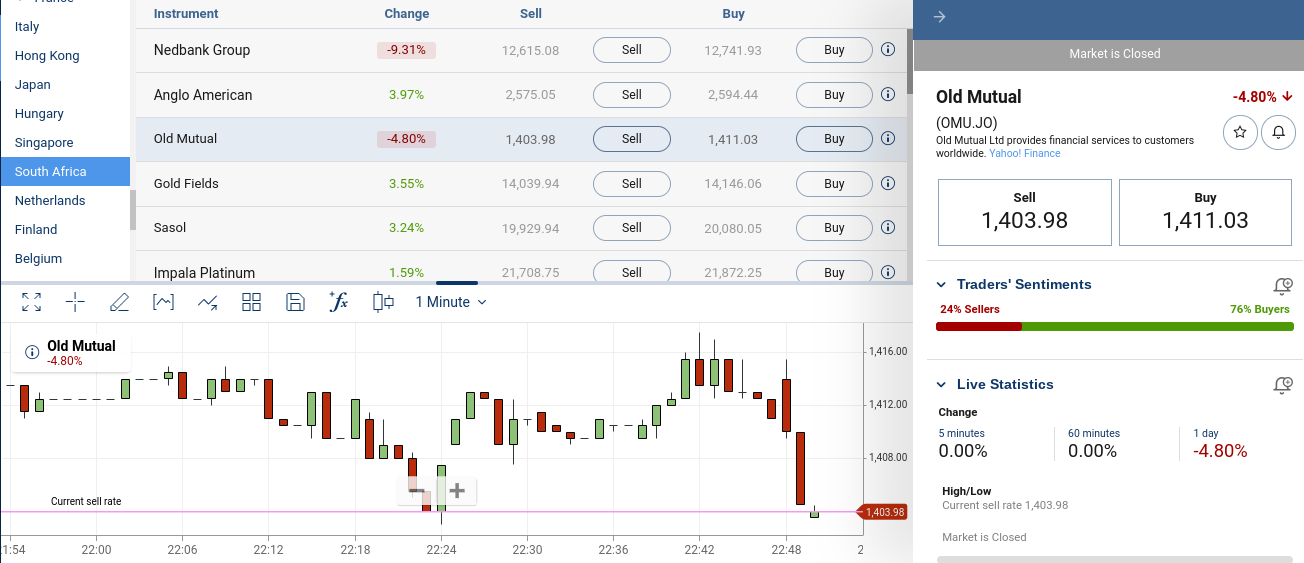

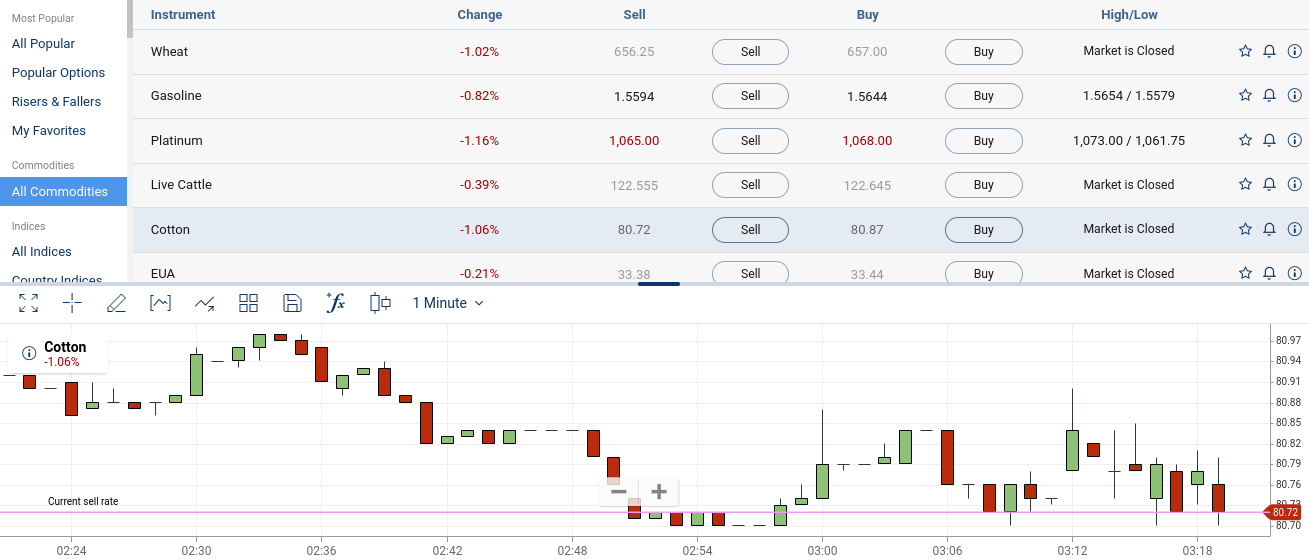

For example, Plus500 lists companies such every bit Sasol, Nedbank Group, Gilded Fields, Anglo American, Impala Platinum, Old Mutual, and many others. As y'all will be trading these stocks via CFD instruments, yous'll benefit from being able to place more than sophisticated positions. For example, Plus500 offers buy and sell orders on all its supported markets - and so y'all can go long and short on your chosen stock CFD.

Additionally, this platform offers leverage, so you lot can amplify your account residuum at the click of a button. Perhaps about importantly, you can trade stock CFDs on Plus500 without paying any commission. Nosotros also like the 'Trader's Sentiment' tool provided by the platform. This tells y'all in percent terms how many Plus500 traders are long on the stock CFD and how many are brusk.

For example, at the time of writing, 76% of traders are long on Old Mutual, with just 24% short-selling. Although Plus500 is our top-rated S Africa trading platform for stocks, the provider offers heaps of other CFD markets. This includes everything from forex and indices to ETFs and cryptocurrencies. Once again, these alternative markets on Plus500 can be traded commission-costless.

If you want to get started with this trading platform, y'all tin can open up an account online or via the Plus500 mobile app. You will demand to meet a minimum deposit of $100 and the platform supports Due south African debit/credit cards and bank transfers. When it comes to the safety of your coin, Plus500 has a peachy reputation. Its parent company is publicly-listed in the UK and it holds a variety of licenses. Crucially, information technology is authorized to accept S African traders on its platform.

Pros:

- A committee-free trading policy

- Tight spreads

- Thousands of CFD markets - including stocks, forex, and commodities

- In-house ttrading platform, available on web browsers and mobile phones

- Plenty of features including risk management tool, price alerts and trader's sentiment tool

- Heavily regulated including various licenses

Cons:

- No social trading tools

- CFDs just

76.four% of retail CFD accounts lose money.

six. Skilling – All-time Trading Platform in S Africa for Cryptocurrencies

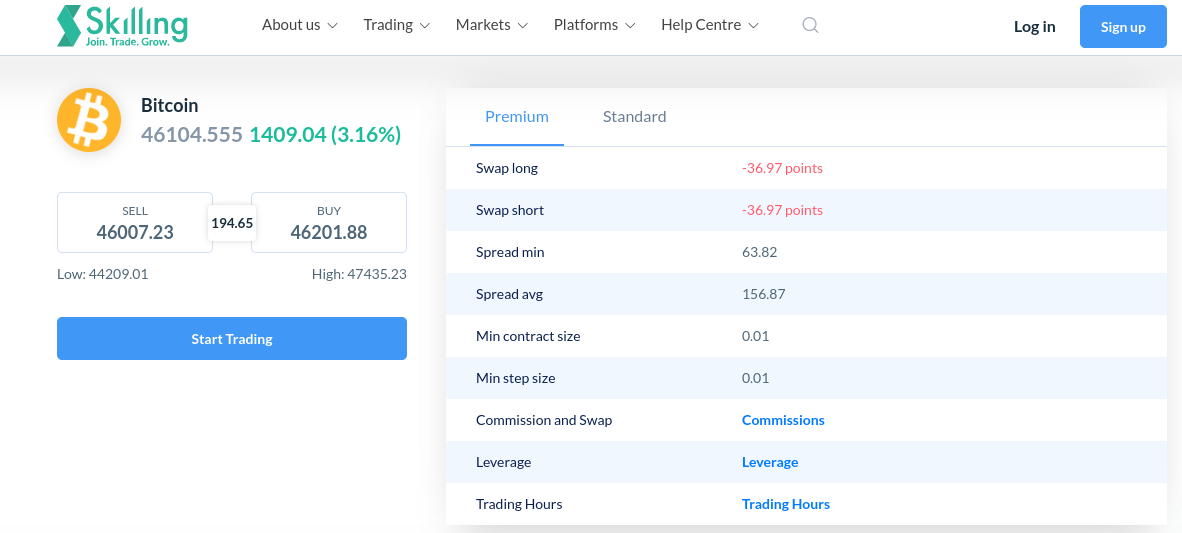

Although most traders in Southward Africa stick with established nugget classes similar stocks or forex, some prefer more volatile marketplaces. If this sounds like you, Skilling is arguably the best crypto trading platform in South Africa. In total, yous can merchandise x popular crypto assets against the US dollar.

Although most traders in Southward Africa stick with established nugget classes similar stocks or forex, some prefer more volatile marketplaces. If this sounds like you, Skilling is arguably the best crypto trading platform in South Africa. In total, yous can merchandise x popular crypto assets against the US dollar.

This includes everything from Bitcoin, Ethereum, and Ripple to NEO, Dash, and EOS. As Skilling specializes in CFD instruments, you won't own the underlying crypto asset. Only, this does give you the selection of shorting your called digital currencies - should you believe its value will decline.

Plus, Skilling offers leverage of upwards to 1:500, albeit, you'll get significantly less when trading cryptocurrencies. Nevertheless, another benefit of using this summit-rated trading platform is that you will non need to pay any commission. Instead, it's only the spread that needs to exist taking into account.

This starts at merely over 63 pips when trading Bitcoin against the US dollar - which is very competitive. Although Skilling is great for cryptocurrencies, the trading platform likewise hosts other CFD markets. This includes heaps of US-listed stocks, indices, forex, and bolt like gold and oil.

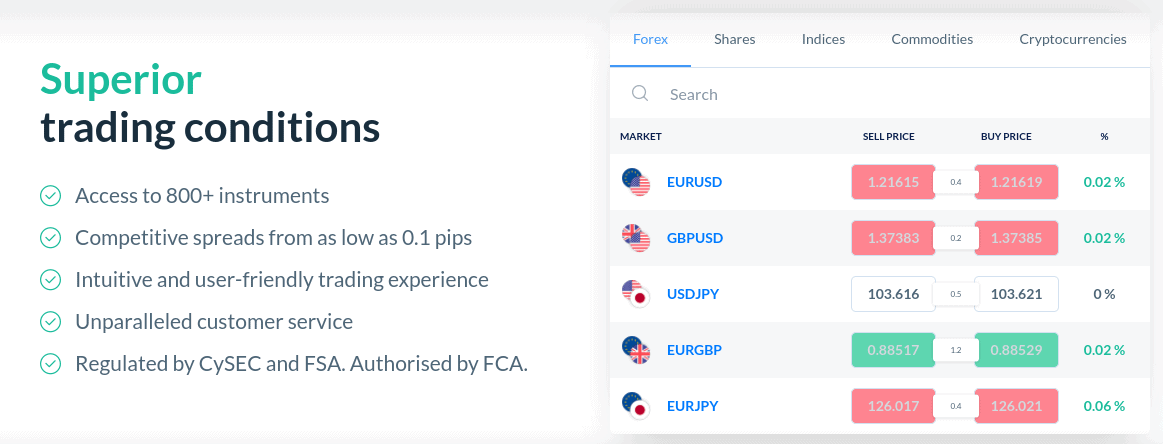

When it comes to the trading platform itself, Skilling covers all bases. This is because you trade via the Skilling platform online or via a mobile app. Or, you can merchandise via popular 3rd-party platforms MT4 and cTrader.

Skilling requires a minimum eolith of but $100 to get started, and many payment methods are supported. This includes debt and credit cards, e-wallets, and banking company transfers. Finally, although Skilling was launched every bit recently equally 2019, it holds fully-fledged licenses with CySEC and the FSA.

Pros:

- More than 800 financial instruments

- Commission-gratuitous share trading with tight spreads

- Great for newbies

- Supports algorithmic trading

- Uniform with MT4 and cTrader

- User-friendly mobile app for iOS and Android

Cons:

- Does not support ETF trading

67% of retail investor accounts lose money when trading CFDs with this provider.

vii. CM Trading – Best Banker in Southward Africa with FSCA License

Launched in 2021, CM Trading is an online trading platform supervised by the FSCA. With more i million clients on its books, this popular trading platform gives you admission to a variety of markets. This includes forex, hard metals, energies, and indices. The platform besides offers CFD Expirations, which are similar in nature to futures.

The only difference is that you will not exist liable to settle the underlying contract on expiry. These futures-like CFD markets cover a pick of indices - such as the Down Jones and DAX, alongside commodities similar natural gas and crude oil. At that place are iii platforms to choose from on CM Trading. This includes Sirix - which was built by the platform itself. MT4 is too supported, equally is a fully-fledged CM Trading mobile app.

When information technology comes to trading fees, CM Trading builds everything into the spread. Nosotros should, however, note that this platform is on the loftier side. For case, EUR/USD averages 1.5 pips while GBP/JPY stands at 5.half dozen pips. There are also overnight financing fees to take into account, should y'all keep a position open up past market place hours. CM Trading offers high leverage limits, especially on forex.

For example, major pairs come up with leverage of 1:200, which is huge. If you opt for this South African trading platform, you lot tin can eolith funds easily. The provider supports wire transfer, debit/credit cards, Neteller, and M-pesa. Finally, nosotros should make reference to the CopyKat characteristic at CM Trading. This is a social trading tool that allows you to select 1 of the platform's summit-rated traders, and then re-create all of their ongoing positions.

Pros:

- Regulated by the South African FSCA

- Trade stock indices, forex, and commodities

- Minimum deposit of just $250

- CopyKat characteristic allows automatic trading

- MT4 supported

Cons:

- Only 150+ fiscal markets supported

Your capital is at hazard when trading at this platform

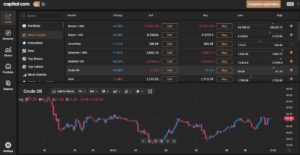

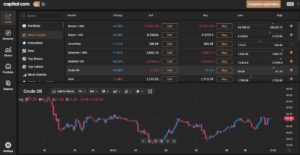

eight . Capital.com - Overall Best and Cheapest Online Trading Platform Due south Africa

Capital.com is our #1-rated trading platform in South Africa. This CFD broker offers trading on more than 3,000 stocks from the U.s.a., UK, and Europe, plus dozens of ETFs and stock indices. You lot can also trade over 140 currency pairs, over 80 cryptocurrencies, and over 50 bolt. If you're looking to trade across a wide range of assets, Majuscule.com is a smashing choice.

Capital.com is our #1-rated trading platform in South Africa. This CFD broker offers trading on more than 3,000 stocks from the U.s.a., UK, and Europe, plus dozens of ETFs and stock indices. You lot can also trade over 140 currency pairs, over 80 cryptocurrencies, and over 50 bolt. If you're looking to trade across a wide range of assets, Majuscule.com is a smashing choice.

Another significant benefit to this banker is that all CFD trades are 100% commission-gratis. Capital.com charges some of the everyman spreads of any banker in South Africa and doesn't have eolith or withdrawal fees. Nosotros besides like that Capital.com doesn't have an inactivity fee, and so in that location's no penalty if you lot take a few months off of trading.

Capital.com has its own, custom trading platform that's packed with features. The technical charts include dozens of drawing tools and studies, and price alerts make it easy to monitor the market. Fifty-fifty ameliorate, Majuscule.com's software includes AI that tracks patterns in your trading. So, you can easily observe ways to better your win rate over time.

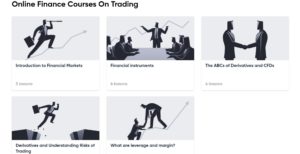

This broker besides puts an accent on trader didactics. Yous'll find dozens of videos and tutorials that walk you through important concepts in CFD trading. You can likewise acquire about popular trading strategies and even test your knowledge with quizzes. Capital.com likewise offers a demo trading account then you can practise trading safely.

Capital.com is regulated by the Great britain Financial Carry Authorisation (FCA) and the Republic of cyprus Securities and Substitution Committee (CySEC). The banker offers 24/7 client support by phone, electronic mail, and live chat. Plus, you lot tin open an business relationship with as little as $20.

Pros:

- Over three,000 stocks, 140 forex pairs, and 80 cryptocurrencies

- 100% commission-free CFD trading

- AI software helps you trade meliorate

- Tons of educational materials

- Regulated past the FCA and CySEC

Cons:

- CFD trading only

- Doesn't support forex signals

How to Cull the All-time Trading Platform South Africa for You

If you read through each of our reviews of the best online trading platforms South Africa, you'll note that no two providers are the same. For example, while Majuscule.com offers thousands of assets commissions-free, the likes of CM Trading offer just 250.

Similarly, while some trading platforms in South Africa offer really tight spreads, others are on the high side. With this in heed, it's all-time to perform some inquiry on your chosen trading platform before taking the plunge.

The nigh of import factors to cantankerous-check when comparison the best brokers in South Africa are discussed in more item below.

Regulation and Safety

All of the best online trading platforms that we reviewed on this folio are authorized and regulated by at to the lowest degree one fiscal body. For case, Majuscule.com is regulated by the FCA and CySEC, while CM Trader and AvaTrade are licensed by the FSCA.

All of the best online trading platforms that we reviewed on this folio are authorized and regulated by at to the lowest degree one fiscal body. For case, Majuscule.com is regulated by the FCA and CySEC, while CM Trader and AvaTrade are licensed by the FSCA.

Either mode, information technology's admittedly crucial that you only open an account with a trusted provider that is regulated. In doing and so, y'all'll benefit from diverse condom nets that unlicensed brokers cannot rival.

For example:

- All of the all-time brokers South Africa discussed on this page are required to keep client funds in segregated bank accounts. In Layman's terms, this means that there cannot employ your money to settle its debts.

- You lot and your fellow traders will need to provide documents as role of a KYC process. This usually includes your Southward African passport or driver'southward license, alongside a proof of address.

- Regulated online trading platforms S Africa must offer a level playing field for all clients. This means condom, secure, and transparent trading facilities - irrespective of how much capital you have.

Ultimately, by opening an business relationship with a regulated trading platform, you can ensure that yous avert unsavory providers, and thus - your money is kept safe.

Tradable Assets

You lot then need to think about which assets you wish to merchandise from the comfort of your home - and whether or non the platform supports it. Additionally, you'll need to bank check how all-encompassing each asset class offer is. For instance, the platform might very well support stocks, but does it offer the specific substitution or market that you want to access?

In particular, if you're looking to create a diversified portfolio of assets, Capital.com is going to be the all-time selection on the tabular array. This is because information technology offers traditional investment avails and CFDs. Regarding the former, this covers over 3,000 stocks, 50 ETFs, and 84 cryptocurrencies. You can also trade CFDs in the shape of hard metals, energies, agricultural products, indices, forex, and more.

Fees

Once yous are sure that your chosen provider is regulated and supports your preferred financial markets, information technology's so time to explore what fees will exist expected of you.

This can be a complicated procedure - equally not all trading platforms in Due south Africa are transparent most what they charge. Additionally, although some platforms offering a commission-free service, these fees are oft countered past the spread.

Below we discuss the nearly important fees to expect out for in your search for the all-time trading platform in South Africa.

Committee

Apart from Libertex, all of the best online trading platforms South Africa discussed on this page offer a committee-free service. This means that you won't pay a fee when y'all enter and exit a merchandise. You lot will, however, demand to factor in the spread - which we cover shortly.

With that said, many trading platforms in South Africa do charge a commission - especially if y'all programme on investing in traditional avails like stocks. This is often charged as a flat fee - so yous always pay the aforementioned irrespective of how much you invest.

Spreads

If your called trading platform is committee-costless, yous should expect the spread to be slightly college than that of a commission-charging provider. For instance, although Libertex charges a pocket-sized commission, it allows you to trade at zero spreads. In the example of CM Trading, the platform doesn't charge whatsoever committee - just its spreads are super wide.

In terms of finding the perfect residual, we institute that Capital.com is the best trading platform in South Africa for low fees. Not just does it not charge whatsoever commission, but spreads on major asset classes are very competitive. For example, forex tin can be traded at a fraction of 0.i%, while baddest stocks average 0.20%.

Other Fees

In improver to spreads and commissions, yous should besides bank check to run across what the provider charges in other areas of its platform.

In particular, look out for the following:

- Swap Fees: Otherwise referred to as overnight financing, trading platforms in South Africa volition charge you a swap fee when you keep a CFD position open overnight. This should over again highlight that CFDs are all-time suited for short-term strategies.

- Inactivity Fees: Even the best trading platforms in Southward Africa charge inactivity fees afterwards a period of dormancy. This is oftentimes afterward 12 months of inactivity and results in a monthly fee until you start trading once again.

- Transaction Fees: Some platforms volition charge you a fee on deposits and withdrawals. This tin vary wildly depending on the platform and the specific payment method y'all wish to use.

- Maintenance Fees: Y'all also need to check whether the trading platform charges a maintenance fee. This is simply a fee that is charged for using the platform. It might be charged as a flat fee or a viable fee that is calculated against the amount of capital you take invested.

If you tin't find a specific fee at your chosen trading platform - this should be viewed as a ruddy flag. After all, regulated trading platforms are required to be transparent virtually what they charge - and so it shouldn't be difficult for y'all to find the information you seek.

Trading Tools, Resources & Features

Some trading platforms in South Africa let you to purchase and sell assets - and nothing more. At the other end of the calibration, some providers give you admission to a full host of trading tools and features.

Some of the all-time resources that we came across are discussed below:

Fractional Buying

If you're looking to invest in traditional assets like bonds, ETFs, and stocks - it's ever useful when the platform offers fractional ownership. This ways that you can invest in your chosen asset without needing to invest in a full security. For example, instead of needing to fork out $40,000 on a single Bitcoin, fractional ownership allows you lot to invest from but $25 up. If you proceeded to invest $40, this would mean that yous own i/1000th of a Bitcoin.

Passive Investing

A lot of South Africans desire to invest in the financial markets, but they have nearly no feel of trading. If this sounds like you, it's best to apply a trading platform that offers an assortment of passive investment tools.

Equally we discussed earlier, AvaTrade offers a Copy Trading service that allows you lot to actively merchandise without lifting a finger. All you need to do is select a pro-trader that you wish to mirror, and the platform takes care of the balance.

Education and Training

The all-time traders in the online space sympathise the ins and outs of technical and fundamental assay. These are skills that can accept a long time to truly master, then we find the best trading platform for beginners offers an assortment of educational materials.

For example, you'll desire access to market insights and trading ideas. Plus, guides, webinars, and podcasts. Essentially, you lot'll want to extract as much key information as yous can to have your trading knowledge to where it needs to be.

Charting Tools and Assay

If yous're an experienced trader then you will know the importance of beingness able to read pricing charts. In lodge to exercise this effectively, you need to choose a trading platform in South Africa that offers advanced technical assay tools. On top of indicators and trading signals, y'all'll want to be able to customize your screen.

Financial News

In addition to technical analysis, long-term investors in the room will point to the importance of financial news. This is peculiarly the case when investing in stocks - and so yous'll desire a trading platform that gives you lot access to company reports and primal accounting ratios.

Some of the best trading platforms in S Africa that we came beyond as well offer real-time news developments. They do this through an integrated news feed with the likes of Morningstar and Thomson Reuters.

Demo Account

If you are looking to bring together a top-rated trading platform in Southward Africa for the very first time - you might desire to hold back earlier you lot brand a eolith. Instead, why non consider trading via a demo business relationship that mirrors real-globe marketplace weather condition?

Not only does this allow you to go a experience for the banker, merely you can besides get to grips with how the trading scene works. Additionally, yous can as well try out trading strategies without needing to risk any funds.

Once you got through the 5-minutes process of joining Upper-case letter.com, y'all'll take access to a demo account with $100k in paper funds.

User Experience

All of the top-rated providers discussed on this folio offer a native trading platform. This means that they congenital the trading platform themselves - typically with a specific type of investor in mind. For example, Capital.com and Skilling take clearly designed their web-trading platforms with newbies in mind.

Not but is it is to find your chosen asset, but placing entry and exit orders are a cakewalk. On the other hand, some of the best online trading platforms South Africa that we came across are all-time suited for experienced pros. This is because the platform will come packed with heaps of marketplace data (such equally depth and order volume volume), avant-garde pricing charts, and enhanced guild types.

These features are going to be great for those of you that know your way effectually a trading platform - only not if you are a beginner. This is why we adopt the best brokers in Due south Africa that offering a demo account. This way, you lot can exam the user experience out gamble-complimentary before making a deposit.

Payments

When you feel prepare to brand a deposit and thus - start trading assets with existent coin, y'all will need to brand a deposit. Most trading platforms in South Africa allow you to brand a depository financial institution business relationship transfer. This volition, yet, often take several days to arrive. Equally such, if the platform supports instant payment methods like a debit/credit card or east-wallet, this is much more convenient.

You likewise need to think that even the best forex brokers with ZAR accounts have a minimum deposit in place. Usually displayed in United states of america dollars, this averages a minimum of $100-$200. That equates to around 1,500 ZAR to 3,000 ZAR. Additionally, certain deposit or withdrawal fees might apply - particularly if you are using an international brokerage business firm.

Customer Service

All of the platforms discussed on this page offer a smooth and seamless trading experience. All the same, there might come up a time when you lot need to speak with a member of the client service team. If the matter is urgent, you lot'll want to cull a trading platform that offers live chat.

Telephone support is also an option, albeit, yous'll need to bank check whether or non a local S African tool number is offered. We likewise find that the best trading platforms in South Africa have a presence on social media. This ensures that the provider has to answer questions in the public domain.

How to Start with the All-time Trading Platform South Africa

You should at present know the ins and outs of how to cull a trading platform in South Africa. Once y'all have selected a provider, you lot'll demand to open an account.

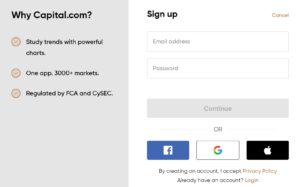

In the walkthrough beneath, we show y'all how to register, deposit, and place your first trade at commission-free platform Majuscule.com in less than ten minutes!

Footstep ane: Open a Trading Account

You'll starting time demand to visit the Capital.com website and open an account. This will require you to provide some personal information, contact details, and a very brief overview of your trading experience.

You will as well demand to choose a username and a strong countersign, and verify your mobile number.

Step ii: Confirm Identity

You lot will also need to upload a couple of documents then that Capital.com tin verify your identity.

This includes your:

- Valid passport or driver's license

- Utility bill or bank account statement (issued within the last 3 months)

In most cases, Upper-case letter.com can verify your documents instantly.

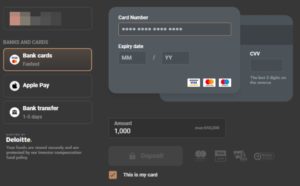

Pace 3: Deposit Funds

Once y'all experience prepare to brand a deposit, you tin can cull from the post-obit payment methods:

- Visa credit/debit menu

- MasterCard credit/debit card

- Banking company Transfer

Step four: Search for a Trading Market

It's now time to search for the nugget that you lot wish to trade. The easiest fashion to do this is to utilize the search box at the top of the screen.

In our example in a higher place, we are looking to merchandise the South African rand confronting the Japanese Yen - so nosotros search for 'ZAR/JPY'.

Stride 5: Place a Trade

To finalize your first merchandise on Capital.com, you will need to set an order.

This is a simple process, every bit you lot simply need to select from a buy or sell lodge - depending on whether you think the asset volition rising or autumn. In our instance, we replacing a buy order on ZAR/JPY, meaning we think the exchange rate volition increase in value.

Nosotros also enter our stake at $100 with leverage of 10x.

Finally, yous need to click on the 'Open Trade' button to execute your committee-free position.

Best Trading Platform in South Africa - Decision

Never before has it been so easy to trade from the comfort of your domicile in Due south Africa. As we have discussed in this guide, the best online trading platforms South Africa allow you to buy and sell thousands of fiscal instruments without you lot needing to pay any commission.

The best trading platform for beginners also give you access to innovative tools - like fractional ownership, Copy Trading, and demo accounts. In determination, we found that Capital.com is the all-time trading platform available to S Africans.

This heavily regulated provider covers everything from stocks and forex to commodities and crypto. Best of all, you won't pay a single rand in commission or maintenance fees

Capital.com - Best and Cheapest Online Trading Platform Due south Africa

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

What is the best trading platform for beginners?

If you're based in S Africa and looking to trade for the very outset time, consider a newbie-friendly platform like Uppercase.com. This provider is now home to 17 million investors - most of which fall nether the umbrella of a retail trader.

What is the best trading platform South Africa for stocks?

If you're looking to trade international stocks found in regions like the US, United kingdom of great britain and northern ireland, or Europe - Capital.com is the best selection on the table. In total, you lot'll have access to over 3,000 stocks - all on a commission-costless footing. Alternatively, if you desire to merchandise South African-listed stocks, Plus500 has you lot covered.

How practice yous trade the rand in Southward Africa?

Many top-rated platforms allow you to trade the South African rand. Capital.com, for case, allows you to merchandise the rand confronting the US dollar and the Japanese yen.

Are Southward Africa online trading platforms safe?

Not all trading platforms offering services to South Africans can be deemed safe. Instead, you demand to ensure that it is regulated past at least one financial body.

What is the best trading platform S Africa for depression fees?

After reviewing dozens of the all-time trading platforms in South Africa, Capital.com came out on top in terms of fees. The platform offers the perfect balance between goose egg commission and tight spreads.

What are the leverage limits in South Africa?

Unlike in regions such equally Europe and the Usa, South African traders are not capped in how much leverage they tin can utilize. This is why some trading platforms in South Africa volition offer you leverage of upwards to 1:500.

Are non-FSCA online trading platforms prophylactic?

Yes, in many cases - trading platforms located overseas are very safe. For example, Capital.com is regulated by two reputable financial bodies - including the FCA (UK) and CySEC (Cyprus).

Source: https://tradingplatforms.com/za/

Posted by: ellismajeough.blogspot.com

0 Response to "Learn Forex Trading South Africa"

Post a Comment